Currently, new cardmembers must pay a $7,500 initiation fee as well as a $2,500 annual fee. One of the few facts about this card that American Express makes public is its annual fee, since card issuers are required to disclose the basic terms and conditions of all of its products. With its $450 annual fee, many credit card users would find the American Express Platinum card to be an expensive card, but the Centurion card’s costs are much higher. And if you have balances on other credit cards, it can help to pay off the entire balance and then wait until after their statement periods ends, so that the zero balance is reported to the major consumer credit bureaus.

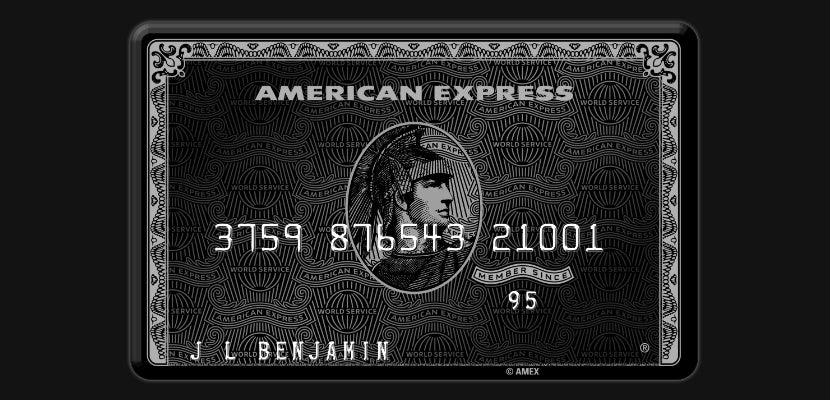

This includes not just the balance from your last statement, but all charges since your last statement closed, bringing your current balance to zero. First, make sure to pay off all outstanding balances with existing accounts, especially those from American Express. Different types of “Black Card”Īs with any other credit card application, there are some techniques you could use to maximize the possibility of being approved for your Centurion Card application. Furthermore, the Centurion card is offered to residents in several dozen countries in Europe, Asia, the Middle East, and South America. And while no exact figures have been released, many observers estimate the threshold for receiving an invitation for the personal Centurion card is currently between $250,000 and $500,000 of annual spending, with business users needing to spend over $500,000 per year. There is a personal card, a business card, and a corporate card. There are also three types of American Express Centurion cards. What is known is that existing American Express customers with very high annual spending habits, high credit scores and immaculate repayment histories are invited to apply for the Centurion card. Unlike all other American Express cards, there is no publicly available application for the Centurion Card, and American Express doesn’t even offer a page on its web site to advertise the card and explain its features and benefits. Currently, the card is made of titanium with a black surface, consistent with its “black card” nickname.Īpplying for the American Express Centurion Card Some even claim that the creation of the card was inspired by persistent rumors and urban legends of an ultra secret black credit card that the super wealthy could use to purchase anything. In 1999, American Express made its most dramatic move up-market by introducing the Centurion Card, named after the officers in the Roman army whose picture is a symbol of the American Express brand and often printed on the face of its cards. The Evolution of the American Express Platinum Card At the time, it had an annual fee of $250, yet today anyone can apply for the Platinum card, it offers an increasing variety of rewards and benefits, and its annual fee has grown to $450. The Platinum card was initially offered to by invitation to existing cardholders who had been American Express customers for at least two years who were high spenders with an excellent payment history. In 1984, it again introduced the Platinum card that was marketed above its existing products. In 1966, Amex introduced its Premier Rewards Gold card that was marketed above its iconic Green card. The history of the American Express Centurion CardĪmerican Express has been issuing charge cards since 1958, and it has been progressively offering premium products to its highest spending customers. Applying for the American Express Centurion Card.The history of the American Express Centurion Card.Here is what you are going to read about: Then, you can determine if this card makes sense for your needs.

New amex centurion card how to#

Let’s take a look at the history of this card, how to get it, and what it costs, as well as its numerous features and benefits. In fact, this card is not even offered to the general public, you have to be invited to apply. Yet it’s also perhaps the least understood as many of its features and benefits are kept secret. The Centurion Card from American Express is by far the most expensive, and exclusive card offered in the United States. Among credit cards, there is one card that stands apart from all others.

0 kommentar(er)

0 kommentar(er)